When Prime Minister Malcolm Turnbull announced that his government would change nothing about Australia’s tax settings on negative gearing and capital gains, one of the Sunday papers ran the headline ‘Safe as Houses‘. Hardly. The Australian housing market is a house of cards – and that’s the view of the property lobby itself, as depicted in the Property Council of Australia’s media campaign against reform of negative gearing.

This is an extraordinary admission as to the basic unsoundness of our housing market. (Similarly honest admissions have come recently from Mortgage Choice CEO John Flavell, who describes the housing market as ‘a very finely balanced and actually pressured system at the moment‘ – which is pretty much the scientific definition of a bubble.) After all, houses of cards collapse, and bubbles burst – and they do so without anyone doing anything deliberate to make it happen. The Government’s and the PCA’s position of ‘JUST. DON’T. TOUCH. IT. DON’T. GO. ANYWHERE. NEAR. IT.’ will not save a house of cards.

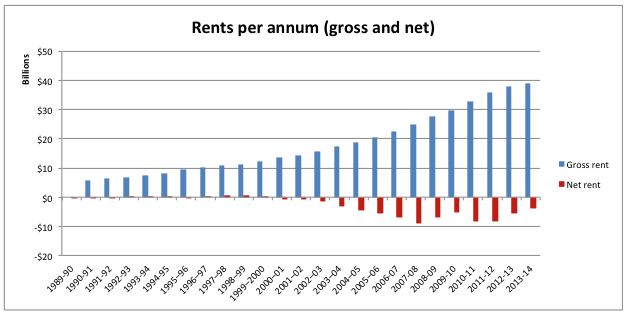

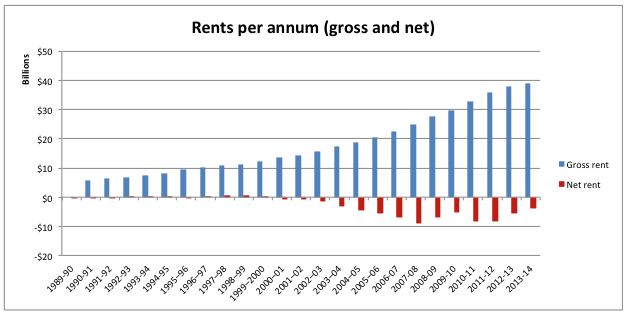

Leaving aside the metaphors, let’s look at some numbers from the Australian Tax Office on negative gearing and rental properties and see how they stack up. First, the total rental income declared by Australian landlords each year, both gross and net of expenses such as interest and depreciation. As you can see, the Australian rental property sector is now a $40 billion per year industry that has run at a net loss since the turn of the century.

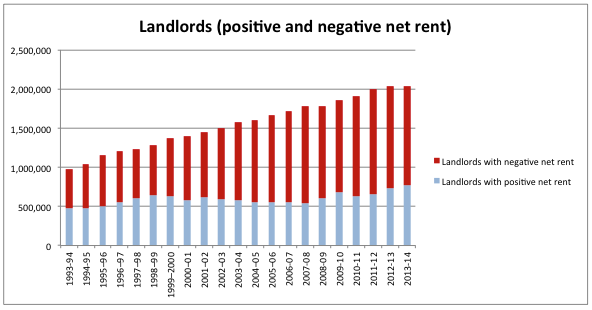

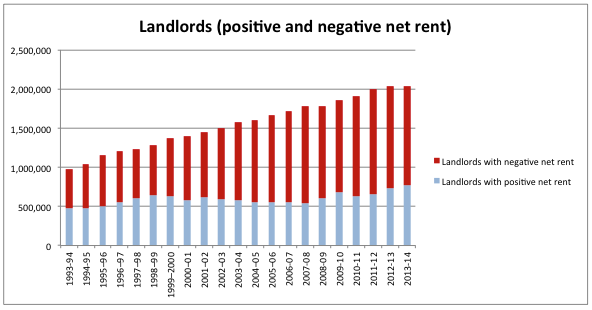

But the number of landlords has grown substantially (by almost 700 000 over the same period). Most of them (63 per cent) are operating at a loss.

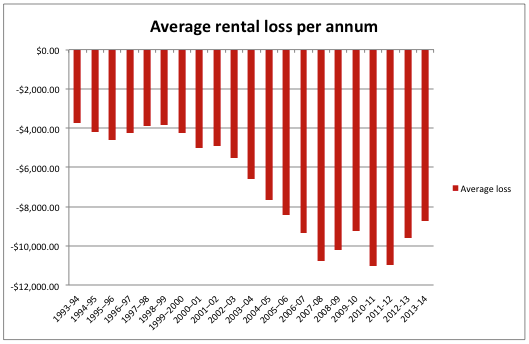

A loss, on average, of almost $9 000 in the most recent year.

Losing $9 000 a year is not ‘saving’ or, as the Government likes to call it, ‘

getting ahead‘. It is only getting ahead if someone comes along later and buys the property from the landlord for more than what they’ve lost.

Now, our tax settings cushion those losses by allowing them to reduce the landlord’s tax liability on their non-rental income – but they’re still losses. And if someone comes along and pays more, our tax settings tax the gains at only half the rate of non-rental income – but that’s still ‘if’ someone pays more. This way of ‘getting ahead’ is a gamble – a gamble on some future person borrowing and spending in an even bigger way than the present landlord has.

And there’s no promise that anyone will pay more, and the prospect of it happening recedes as the costs of servicing huge debts consume too much of people’s incomes, and too many people cannot credibly promise to pay such debts off.

(Source: RBA Financial Stability Report, April 2016)

And as the prospect of finding someone to pay more recedes, we should expect more landlords to look to cut their losses, bring their properties to the market, and bring on the fall in prices – the collapse of the house of cards.

Of course, it is not only landlords who are affected. As more people have gambled on property as landlords, they’ve bid up the prices and the amounts borrowed by owner-occupiers – whether to buy houses for their own shelter, or

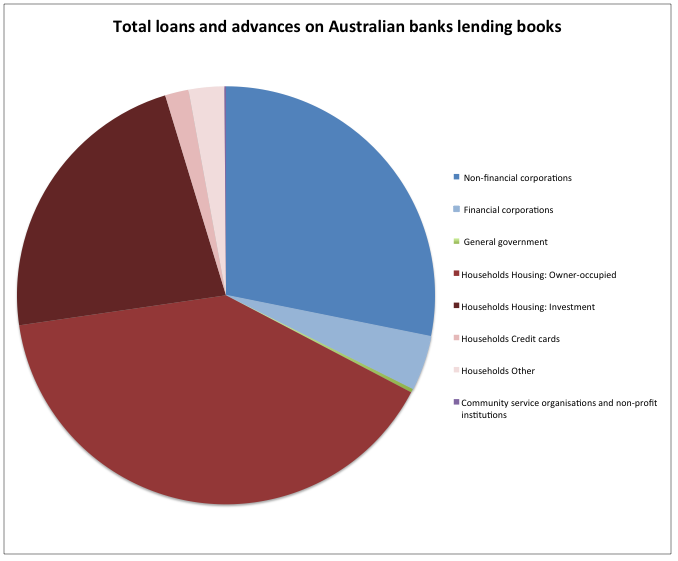

to speculate in their own housing, or some degree of both. And as landlords have gambled with borrowed money, so have the banks gambled too, and become hugely exposed to the housing market. Loans to landlords – or, viewed the other way, landlords’ promises to pay back with interest – are a major asset of Australian banks. Of the

$2.3 trillion of loans on their books, loans to landlords comprise about

23 per cent of all loans by value, and adding loans to owner-occupiers brings total loans for housing to about

63 per cent.

(Source: APRA Monthly Banking Statistics, March 2016)

As prices fall, those promises to pay back with interest become less credible, and the backing they give the banks’ own creditworthiness is diminished. As the

Murray Review last year concluded, our tax settings around negative gearing and capital gains tax have made ‘housing… a potential source of systemic risk for the financial system and the economy’.

Frightening stuff – but instead of being paralysed by it, or willfully blind to it, as the Government appears to be, we should be exercising our minds as to how we could have gotten to the present point, and setting our tax policies so that in future people are not induced to take on such huge debts, and waste so much of their creditworthiness on gambling, and instead use it to develop the means for producing more and better goods and services that increase real prosperity.

And when the present house of cards falls – with or without tax reform – and bank money contracts, we’ll need the Government to use its fiscal power to maintain incomes and employment, and to do justice with respect to all the liabilities that are left standing. The matter of doing justice after a collapse is something that no party has yet addressed.

I totally agree, Australian housing market is a big house of cards.Thanks for the post

But there is a plan – The immigration (and foreign buyer) ponzi scheme. Keep bringing 300,000 new players in each year, and take their money. And lots of foreign investors. And bring in all the super money, by stopping that tax loophole. So you’ll always be able to sell higher, forever. Buy now, the ponzi will go forever. Australia, the property economy, like Spain till 2007.