Australian Construction Insights (ACI) released their latest brief last Monday 18 July and noted that for the first time in Australia, construction starts for multi-unit housing were higher than for detached housing. Of course, there ought to be caution in reading these figures, as any decent geographer will tell you, location and scale plays a big part of this overall picture. That is to say, the local experience is quite varied nationally.

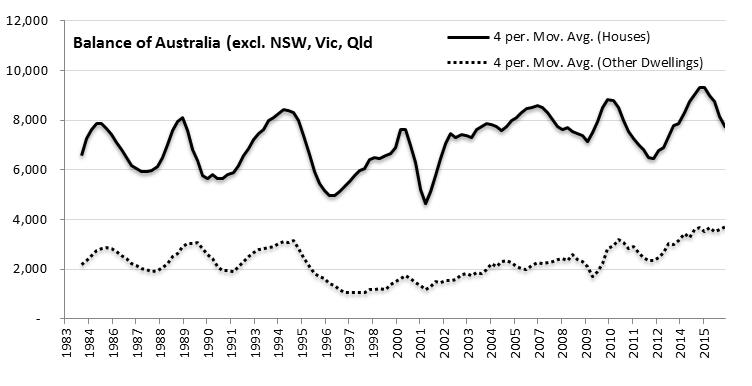

These figures highlight, firstly, the dominance of the three largest cities in these statistical measures. In New South Wales, the detached versus other housing lines crossed in 2012, and there had been virtually a 50/50 split in dwelling starts by type since 2002. In Victoria and Queensland, the trend is similar to national figures, with trend lines crossing sometime in 2015. The remaining metropolitan centres of Australia are following a pattern quite different, and probably much closer to historical trends.

Figure 1: NSW dwelling starts for houses and other dwellings (source: ABS 8752.0 – Building Activity, Australia)

Figure 2: Balance of Australia (excl NSW, Vic, Qld) dwelling starts for houses and other dwellings (source: ABS 8752.0 – Building Activity, Australia)

While this marks a significant milestone nationally and perhaps indicates the shape of things to come in the near future, it is not immediately clear what this actually means for housing in Australia. It perhaps raises more questions about where Australia’s housing is headed and what the future holds for those outside the owner occupied housing market.

Multi-unit housing has been dominated by investors rather the owner occupiers with analysis of 2011 census figures suggesting that between 62% and 67% of flats units and apartments in the three biggest cities owned by investors. These figures are virtually the complete opposite of aggregate levels of home ownership for all housing types. Anecdotal evidence also tells us that the rate of investor ownership is much higher for new apartments. This effectively means that now over half of all new building stock in Australia is being constructed to meet investor demand. This also means that the majority of housing now being built is for people who will never live in these properties.

If this trend holds up, then it is likely we will very soon witness a radical departure from the historical model of housing provision in Australia. Popular politics and policy for housing has predominantly focused on securing a pathway for new households in home ownership. This rhetoric has not changed, despite the reality clearly shifting for an increasing share of younger or new households over the past decade. This has led some to suggest the emergence of ‘Generation Rent’, with a growing body of households who will never afford to make this transition. This observation has all but been confirmed in the release of the latest instalment of the HILDA survey, which also suggests that renters will outnumber owner occupiers by 2017.

Of course owner occupation is not the only answer, with many European countries, for example, having much higher rates of rental. For the most part these new dwellings are available for rent, so it does meet some entrenched housing demand, however the problem in Australia is that unlike these European countries, rental tenancy laws and investment patterns are manifestly inadequate at ensuring long term tenancy options that gives renters the security to occupy dwellings as their own. The balance of power is firmly stacked in favour of landlords to protect the speculative value gains that have been a long characteristic of housing property in Australia. Not only is this unearned increase in value socially unproductive (it does not produce anything of benefit to society) it is now blindingly apparent that it is socially counterproductive. Housings costs for many are extreme.

This failure to recognise the claims of renters as equal citizens with home owners in the housing debate is in part a product of the long history of privileging ownership over rental that has created a policy vacuum in the rental sector. Housing policy needs to shift to recognise housing as a place that people need to live, not as a tool for middle class rent-seeking.

With such a high proportion of demand coming from owners whose motivations are governed by a different set of criteria than those who see these dwellings as long term living option, the relationship between housing and social need has become detached. The economics of the dwelling product is likely to reflect investor desires, which are not necessarily the same as occupiers. The assumption has been that households will trend away from apartments as they have children, but the reality of the current housing markets means this is not guaranteed. The trend between the last two censuses indicates that family households are increasing their share of households in apartments. This underlies the unsuitability of many of the new dwellings for family households and the inflation of houses prices increasingly being detached from wage growth.

So where does this leave us?

The latest figures on dwelling construction all but confirm that these trends will continue in the short term. It is hard to see any radical shifts in the housing policy domain away from privileging investment over occupation in the near future, however something has to give sometime soon. The obscene unaffordability of housing in Sydney in particular, coupled with a housing supply chain that is becoming increasingly detached from housing need or aspiration spells trouble. The rising resentment of younger generations at the stark wealth divide in housing should be cause for concern and ought to be a warning for the political elite who claim to govern in their name. The political voice will only grow louder as the size of this group grows.

Great article. Now that we are a few months on has constructions starts slowed? I imagine that the availability of finance for projects is drying up quite a bit.