By Duncan Maclennan, Jinqiao Long, Hal Pawson, Bill Randolph, Fatemeh Aminpour and Chris Leishman. Originally published (and headlined) by John Menadue’s Pearls and Irritations. Image credit – Unsplash.

Housing unaffordability is causing real economic damage that governments must treat more seriously. Put simply, rising mortgage debt poses risks for national economic stability, while current housing policies contribute to stagnating economic productivity and growth. Furthermore, when lower income workers have access to affordable housing near innovation hot spots and growth industries, the economy benefits.

For too long, policy makers have treated rising house prices as something to be celebrated as a signifier of political and economic success. Australia’s housing market has been regarded an efficient, smoothly operating system. By a margin of more than two to one the leading Australian economists and housing market experts who took place in our recent survey explicitly rejected this belief.

Productivity arguments now rival welfare arguments

There are obvious implications for a society’s wellbeing and welfare when buying a house is out of reach of most ordinary income earners, and when the less well-off are increasingly confined to insecure and unaffordable rented homes. But increasingly the productivity concerns around housing are at least rivalling welfare concerns.

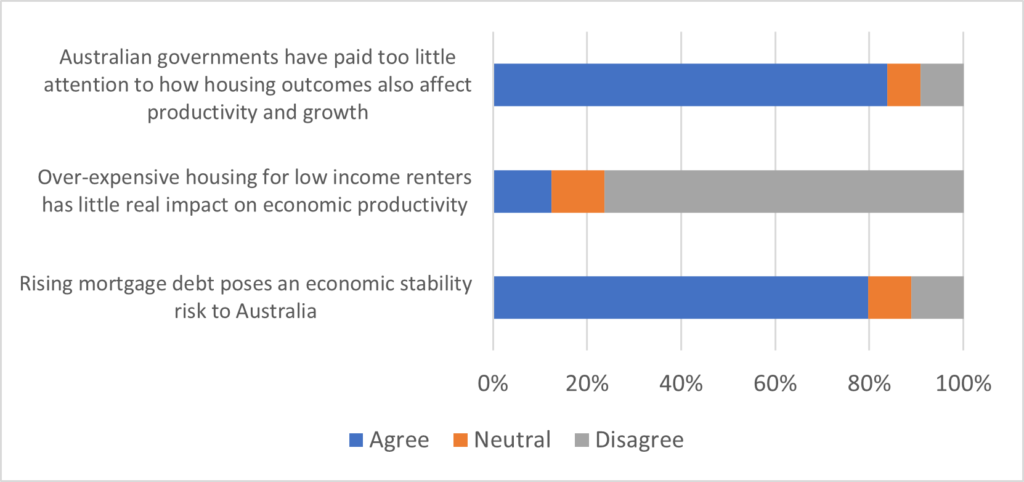

New survey evidence indicates that Australia’s top economists and housing policy experts see a major disconnect between government policy on housing and the wider economic impacts of an increasingly underperforming housing system. Some 84% of respondents (and 73% of economists among them) agreed with the proposition that Australian governments pay insufficient heed to the effects of housing outcomes on productivity and economic growth.

These findings come from our survey of leading economists (47) and other housing experts from government, industry and academia (40). They indicate strong backing for the view that housing unaffordability is a policy challenge that governments must take more seriously, not just because of its welfare and wellbeing implications, but because of the economic damage that results. Large majorities of our expert respondents agreed that high rent burdens for low-income tenants impair economic productivity, and that rising mortgage debt poses risks for national economic stability.

Survey participant responses to stated propositions (% of respondents)

Source: Authors’ survey

Housing policy priorities

Current trends suggest that demand for housing at the lower end of the market has escalated dramatically. Public housing waiting lists have grown by 4% in the past year, while priority (high need) applications have spiked by 11% in 2020, and by 54% since 2016 (from 37,897 to 58,511). Since the 1990s, Australia’s social housing supply has effectively halved.

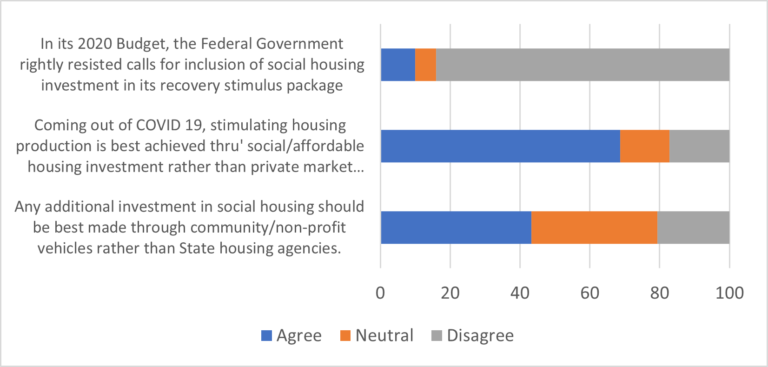

Concerns over the intensifying shortage in social housing were also strongly reflected in our experts survey. An overwhelming majority believed the Federal Government made a mistake in excluding social housing investment from the post-pandemic stimulus efforts. By a margin of eight to one, the experts disagreed with the proposition that omission of such measures from the 2020 budget was well-judged. Moreover, 57% overall (and even 51% of economists) strongly disagreed.

Challenging the Government’s singular focus on its HomeBuilder private housing subsidy scheme, two thirds of experts preferred housing sector stimulus directed at the non-market sector rather than market housing. Since only 17% disagreed, the margin favouring non-market targeting was almost four to one. Experts also generally backed the proposition that any such effort should be channelled through not-for-profit community housing providers rather than state/territory governments.

Survey participant responses to stated propositions (% of respondents)

Source: Authors’ survey

Housing policy, demographic change and economic productivity

The connections between adversity (and opportunity) and economic productivity are well documented. So, too, are the links between high incomes, asset wealth and economic stagnation. Some commentators have estimated that international migration has delivered between half and two thirds of Australia’s economic growth over the past 30 years. Other studies show that it takes 20-30 years for migrants to Australia to converge on Australian-born levels and patterns of consumption and income (the implication is that they work disproportionately hard during that period, to close the gap).

Of course, international migration has largely dried up during the pandemic, and is unlikely to return to previous levels for some years, if ever. The implications on population ageing and declining economic growth are problematic.

Unfortunately, due to current policies, our housing market contributes to stagnating economic productivity and growth, over and above the well-documented impacts on wealth inequality. Central to this is the way ever higher property values compound the gap between owners and others. The negative consequences of rising inequality for productivity and growth have been increasingly highlighted by international institutions such as the IMF and the OECD, by the Reserve Bank in Australia, by Thomas Piketty and, now, by a leading cohort of Australian economists and policy advisors.

In this, and in many other ways we have explored elsewhere, the economic damage that results from the (under)performance of our housing system must prompt Australian governments to re-think their outdated assumptions underlying the low priority they attach to housing challenges. The case for far-reaching policy and governance reforms in this sphere is not just an argument about enhancing community welfare, it is fundamental to enhancing national economic performance.

Consistent with the concerns of leading Australian experts and economists, current stimulus directed exclusively at the home-ownership sector has induced sharply rising house prices that will further exacerbate wealth and residual income inequalities and reward ownership rather than entrepreneurship and effort. Stimulating rental housing provision, especially for the working poor, could promote productivity, stability and fairness. Australia’s modern battlers deserve better designed housing-economic policies.

Survey respondents were drawn from academic, industry and government sectors. Most were trained economists, at least 15 of whom were members of The Conversation’s Economics Panel. Respondents were mainly employed in senior positions such as Professor, Partner or CEO. Further details are in our published report.

No Comments so far ↓

There are no comments yet...Kick things off by filling out the form below.