By William Thackway & Bill Randolph, City Futures Research Centre. Originally published by the Fifth Estate.

In Australia, where more than 60% of voters own their own home, the notion of housing reform policies that may negatively impact housing prices is widely viewed as “political suicide” (Raabus, 2021). The term has been used to describe moves to reinstate both inheritance taxes (largely relating to property inheritance) and attempts to abolish negative gearing (Buckley, 2021; Caldwell, 2019). When Bill Shorten vowed to grandfather negative gearing and halve capital gains tax concessions in the 2019 election, the policy was weaponised by the coalition government who claimed that it would stop “everyday families” from aspiring to buy investment properties (Remeikis, 2021). That housing reform was one of the first policies on the chopping block when Anthony Albanese assumed the Labor party leadership in 2019 spoke to its perceived unpopularity.

However, the COVID-19 pandemic has exacerbated several existing housing financial stresses and reinvigorated calls for a national housing plan (Pawson, et al, 2020). On the one hand, the impacts of COVID-19 have been disproportionately felt by low-income renters, who tend to be low-skilled workers at the greatest risk of losing employment (Maclennan et al., 2021). In the first six months of 2021 alone, the proportion of renters spending more than two-fifths of their income jumped by 8 percentage points to 68% (Sweeney, 2021). On the other, low interest rates have stimulated surging house prices and driven first-home buyers to take on increasingly aggressive mortgages (Switzer, 2021).

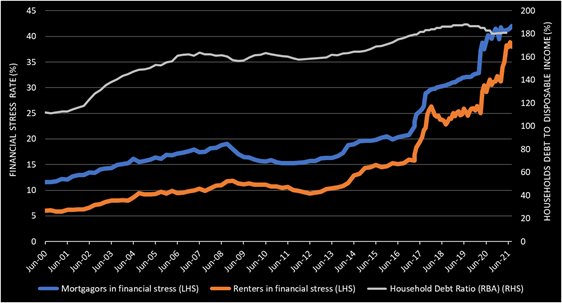

As Figure 1 shows, financial stress rates had risen steeply after 2017 for both renters and mortgagors but plateaued until the outbreak of the pandemic in early 2020 when it ticked up sharply, initially for mortgagors and then for renters, to the point where both tenure groups were facing comparable rates. By August 2021 the stress rates had reached 42% for mortgagors and 38% for renters (Thackway & Randolph, 2021). For mortgagors this figure is almost four times the level recorded in 2000 and has risen in the context of a parallel increase in overall household debt to income ratios over this time, with only the aftermath of the GFC providing a temporary respite. But for renters, the current stress figure is six times the level recorded in 2000.

Figure 1: Mortgagor and renter financial stress rates Q1 2000 – Q2 2021

While financial stress among renters and mortgagors was significant prior to the onset of COVID-19, the pandemic has only served to underline the existential threat they pose to Australia’s housing market. The question beckons: is there a tipping point of housing-related financial stress for which housing reform becomes a politically viable strategy? If the number of people in housing-related financial stress starts to outnumber those with personal interest in the continued prosperity of the housing market, will the political outlook of housing reform change?

To investigate the state of housing-related financial stress in Australia, we analysed household financial survey data compiled monthly by Martin North from DFA. The data is sourced from a monthly survey of 4,300 households which creates a rolling pool of 52,000 households annually. The survey asks specific questions on household income and expenditure to calculate a ‘mini’ cashflow analysis for each respondent: money in vs. money out. Households with a ‘residual’ income after normal expenditure (including housing costs) of less than +5% or have negative residual incomes are classified as stressed. Additional questions record the household’s housing tenure position.

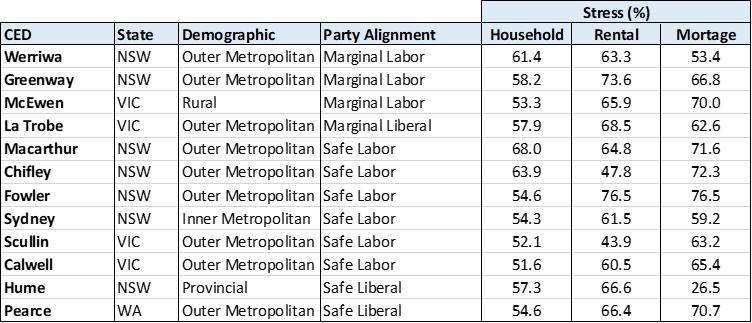

For this analysis, the data, originally aggregated at the Postcode level, were reaggregated into Commonwealth Electoral Divisions (CED) to investigate the political landscape of housing-related household financial stress (Guiliano, 2021). Using the DFA survey data, two measures of housing-related financial stress were calculated at the CED level:

The first calculates the proportion of mortgagor households in financial stress. The second calculates the proportion of all households that are renters or mortgagors in financial stress.

A measure of political alignment for each CED was then constructed using the Australian Electoral Commission divisional classifications data from the 2019 federal election (AEC, 2019). The data contains information on the geographical demographic, successful party, and seat status (‘safe’, ‘fairly safe’, ‘marginal’) for each CED from the 2019 election. Based on the successful party and seat status, a party alignment measure was constructed for each CED, whereby marginal seats were classified as ‘marginal [successful party]’, safe or fairly safe seats were classified as ‘safe [successful party]’. Using the financial stress and party alignment data, we examined where the most financially burdened constituencies in Australia are, how this related to housing tenure (buying or renting), and what the political base of these constituencies comprise.

__

Most Financially Stressed Constituencies

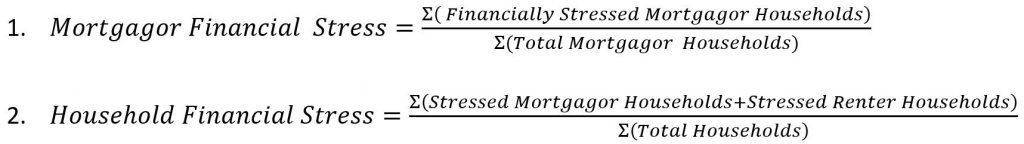

Table 1 examines the top 20 ‘mortgagor-stressed’ constituencies in Australia sorted by party alignment. Financial stress rates among this cohort range from 59% (McEwen) to 76% (Macarthur), representing well over a majority of mortgagors. While NSW and Victoria make up a majority (16) of the top 20, all States other than South Australia feature in the list. Furthermore, there is a mix of both metropolitan (11) and regional (9) areas. Finally, all the major parties feature strongly in the list. Marginal seats make up over a third (7) of the constituencies with highest proportions of financially stressed mortgagors (four Labor, two Liberal and one Independent), while overall, Labor (12) has a larger share than the Coalition (7). Ultimately, the top 20 mortgagor-stressed constituencies demonstrate both the breadth and depth of financially stressed mortgagors across Australia.

Table 1: Top 20 CEDs by financially stressed mortgagors

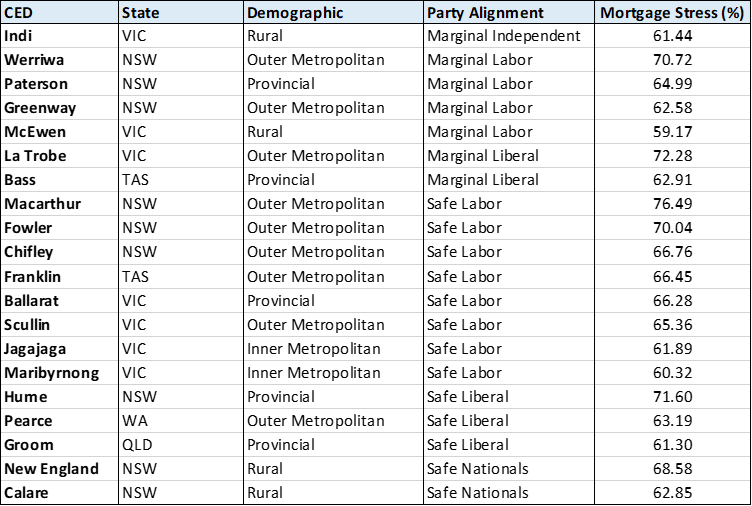

Table 2 lists the 12 CED’s where a majority of all households are in overall financial stress – that is, the number of both mortgagors and renters in difficulty as a proportion of all households. NSW (7) and Victoria (4) again feature strongly, and there is a strong trend towards outer metropolitan regions being most affected. While the share of Labor seats (6 Safe, 3 Marginal) outnumbers Coalition seats (2 Safe, 1 Marginal), both sides of politics have significantly burdened constituencies. For these seats, irrespective of the proportion of mortgagors or renters, a majority of voters face financial stress. Intuitively, this would mean that the voter bases of these constituencies could have a potential financial self-interest in government policy that helps them to reduce the pressure of ever escalating housing costs, especially over the longer term – either through reduced rental prices, an increase in government-supported housing, or moderating house price inflation. Conceivably, these constituencies may represent the emerging locations where a tipping point of housing-related financial stress has been reached, after which the political viability of housing reform shifts from the inconceivable to the possible.

Table 2: CEDs with a majority of households in financial stress

__

Analysis of Household Financial Stress by Political Alignment

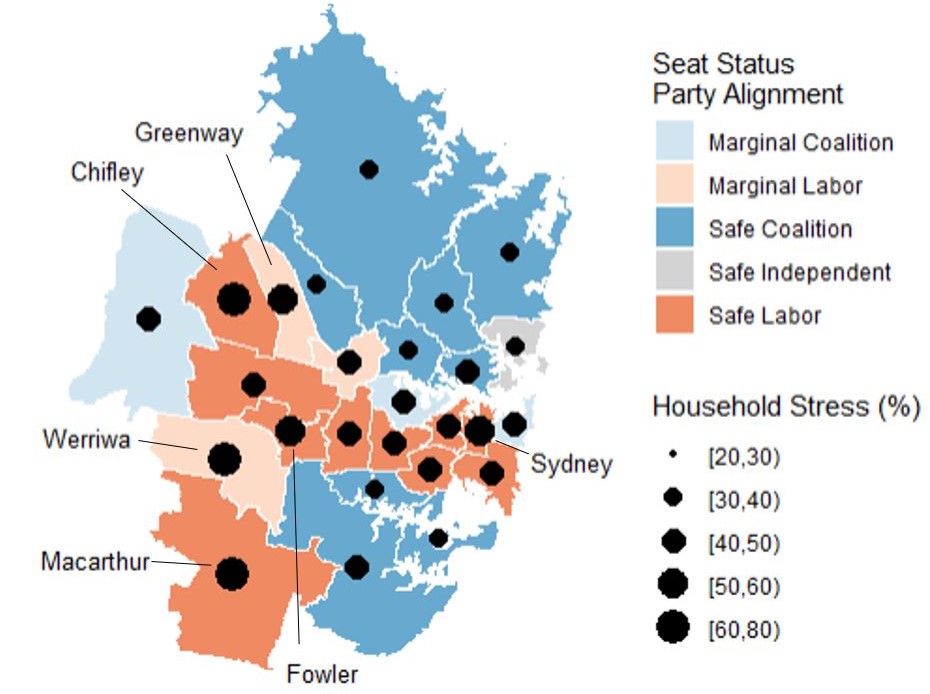

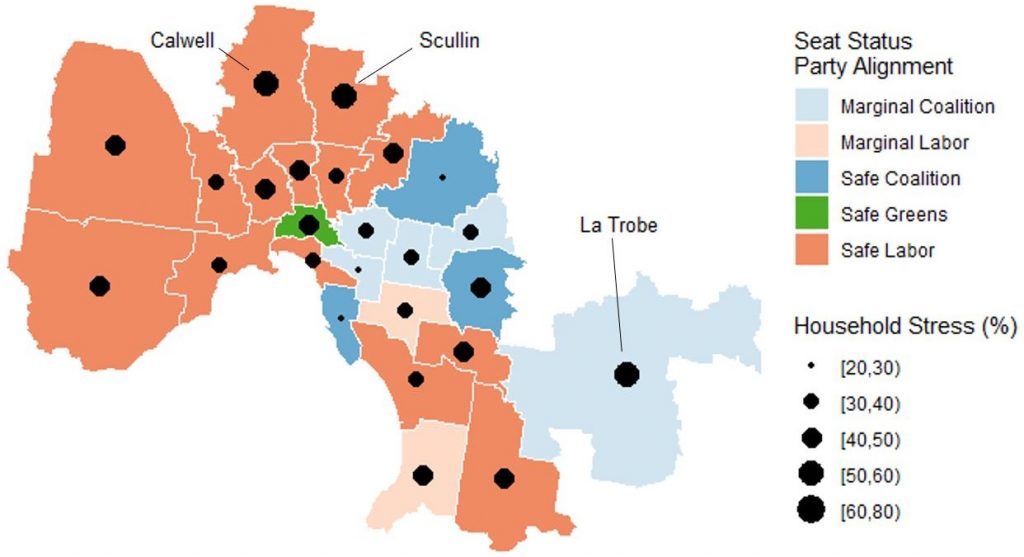

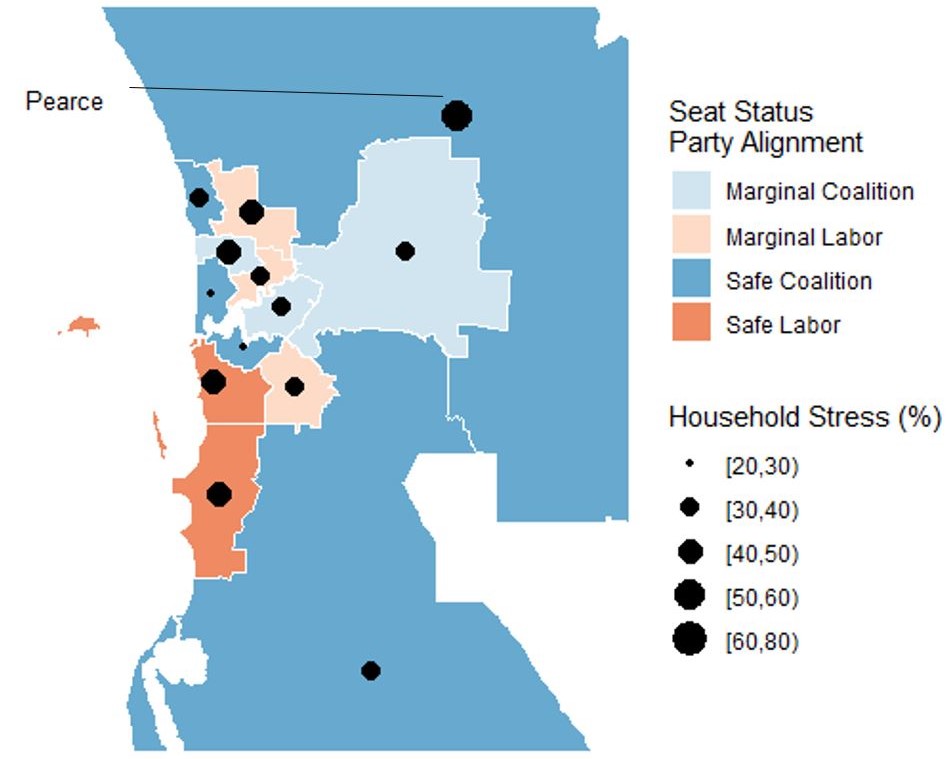

The following maps visualise the Federal political alignment of a city’s constituencies (2019 election), overlayed with a dot representing the level of household financial stress in each CED. Larger dots represent higher levels of household stress (i.e. financially stressed mortgagors and renters as a % of all households), and vice versa for smaller dots. Seats with a majority of households in financial stress are labelled. Sydney, Melbourne, and Perth were selected as the three major cities with the highest level of financial housing stress.

In Sydney, no constituencies recorded household financial stress levels of below 30% (Figure 2). There is seemingly a clear relationship between household financial stress and party alignment. The coalition seats in the city’s north and south have comparatively low levels of stress. By contrast, Labor seats close to the centre, west and south-west all have households stress levels above 40%. However, the six marginal seats, hailing from both sides of politics, also all have household stress levels above 40%. Other than the seat of Sydney in the city centre, the other five constituencies with a majority of households in financial stress are located to the city’s far west and south-west. This reflects a general trend of higher housing stress levels towards the city’s outer areas.

Figure 2: Sydney Household Financial Stress by Political Alignment

Melbourne shares several distinct housing financial stress trends with Sydney (Figure 3). Constituencies with the highest levels of household stress are again largely located towards the periphery of the city, including the three seats where a majority of households are in financial stress. As in Sydney, Coalition seats tend to have lower levels of household stress than Labor seats, with the exceptions of La Trobe and Aston in east Melbourne. Finally, housing stress across the city is generally high, with only three constituencies recording household stress levels of below 30%.

Figure 3: Melbourne Household Financial Stress by Political Alignment

In Perth, six of the 13 constituencies recorded politically marginal results in the 2019 election. All of these recorded moderately high levels of housing financial stress (Figure 4). Household stress levels are nevertheless generally lower for Coalition seats, with the exception of the Pearce constituency towards the northern fringe of Perth (> 50%). On the other hand, both the safe Labor seats south of the city centre have household stress levels of over 40%. In keeping with both Melbourne and Sydney, household financial stress is more common in outer-metropolitan areas.

Figure 4: Perth Household Financial Stress by Political Alignment

__

Key Takeaways

Analysing the financial survey data provided by DFA illuminates both the breadth and depth of housing-related financial stress in Australia. In twelve constituencies a clear majority of households are burdened by significant financial stress, while many key suburban seats display substantial levels of stress. Although Labor seats tend to be more affected than Coalition seats, financial stress is clearly a bi-partisan issue, including in several key marginals. And it’s also evident that no part of Australia is immune from these pressures, with constituencies from the inner city to rural and regional districts suffering high levels of financial stress.

With a general election looming and housing stresses exacerbated for both the rental and mortgage sector by the COVID-19 pandemic, it’s reasonable to ask: where is the discussion of housing reform? However, at the Federal level both major parties are clearly avoiding housing as an issue for fear of upsetting either John Howard’s suburban ‘Battler’ vote or the army of ‘Boomer’ property owning retirees. In this context it’s difficult to see how a coherent housing reform policy package can be put back onto the agenda.

It is to be hoped that the current Parliamentary Inquiry into housing supply and affordability (Parliament of Australia, 2021) will lift its gaze away from the easy target of blaming the planning system for all our housing woes and conclude that integrated reform is needed across all three levels of government if we are to turn away from the speculatively fuelled ‘boom and bust’ property cycles and the mounting unaffordability crisis that current policy settings have created.

The data presented here should give the members of the Parliamentary Inquiry pause for thought. In the past, politicians have faced the seemingly impossible task of convincing the majority home-owning voter base to support policies that may restrain house price growth or threaten the almost unending ‘money pot’ of housing investment, let alone make better provision for renters. But the extent of household financial stress among both home buyers and renters – many of whom the Boomers’ children who aspire to buy but see the prospect receding by the day – related to ever escalating housing costs, may prompt a greater degree of voter support for systematic policy reform. The question is, have we reached the tipping point, and if not now, when?

No Comments so far ↓

There are no comments yet...Kick things off by filling out the form below.