Modeller to the property industry, BIS Shrapnel, reckons reforming negative gearing would increase rents by 4-10 per cent. Is that right?

First, always keep in mind that when property interests ‘warn’ about rent increases, you should suspect an ulterior motive. Landlords and their representatives aren’t worried about or afraid of rent increases – they love them! It’s more money for them – that’s why they increase rents whenever they think the market will bear it.

No landlord has ever accepted less than the going rent just so that they can be negatively geared. Instead, if they find that the going rent is more than their liabilities (interest, etc), the dedicated gearer will go back to the bank, borrow more money and buy more property.

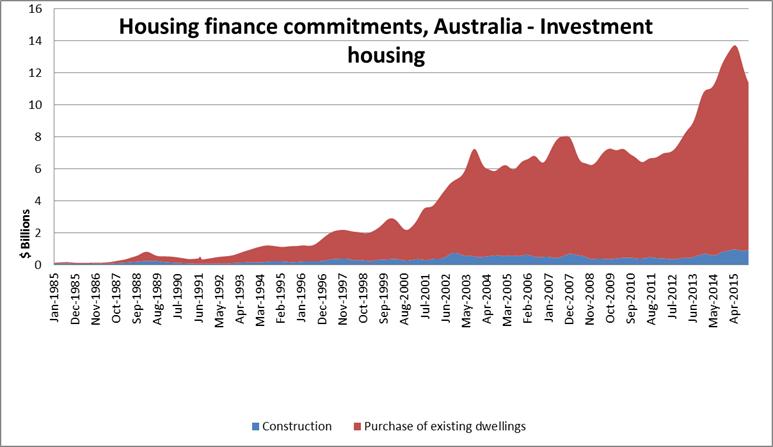

Which brings us to a second point. Negative gearing doesn’t cause landlords individually to lower their rents, and it doesn’t really help bring on additional supply that might push rents down across the market. It has been the case for a long time that the money ‘investors’ borrow to spend on property goes overwhelmingly into existing properties.

(ABS 5609.0 – Housing Finance, Australia, Dec 2015, table 9)

These purchases are of properties either already rented, or that would otherwise be owner-occupied – either way, there’s no net addition to rental housing supply.

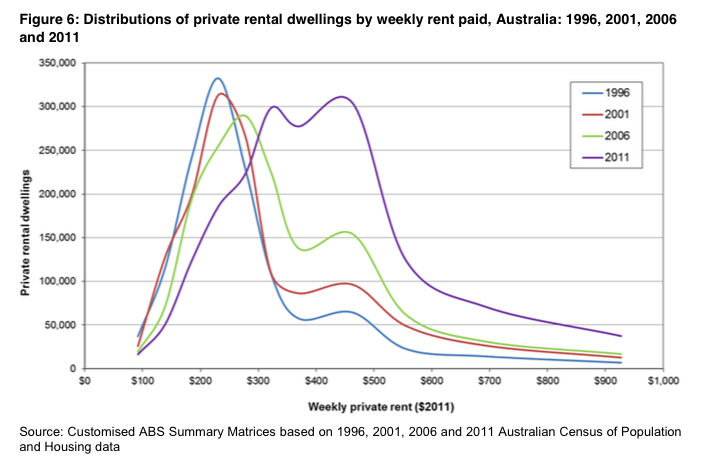

What these purchases have done, however, is change the shape of the rental market – both in terms of the stock on the market, and the people renting it. That’s because ‘investors’ have been making speculative purchases of higher value properties that can be sold later to another speculator or owner-occupier with money to throw at property; at the same time, more higher income households, priced out of owner-occupation, are renting and out-competing lower income households for the relatively scarce affordable rentals.

(Hulse, Reynolds, Stone and Yates (2015))

So, as one of the factors that has fanned speculation in housing, negative gearing has helped push rents up, particularly for low-income households. And reforming negative gearing, along the lines recently proposed by Labor, to dampen speculation and direct investment to new supply, should help reshape the rental market into one that more reflects the demand for rental housing by households across the range of incomes, than punts on what will attract a premium from subsequent geared-up purchasers.

But… could rents rise as an immediate response to negative gearing reform?

The experience of the short-lived 1985-87 reform of negative gearing doesn’t support this, as rents went down, up and sideways, depending on the city, over that period.

When it comes to the present proposal, existing investors would be grandfathered, so their costs will not rise upon implementation of the reform. Even so, the prospect of capital gain will decline, so some of them might exit the market – but they won’t wind up (destroy) their property, they’ll sell it. If they sell, it will either be to another investor – so no reduction of supply – or into the owner-occupied sector, thus making room for a renter to leave the rental sector – so no net reduction of supply.

New negatively geared investors in existing housing coming after the reform would face relatively higher costs (as the part of their non-rental income consumed by the net cost of their investment would be taxable), and they may want to push that cost onto tenants. However, most of that cost, being interest, is not avoidable by having no tenant, so that should discourage them from holding out unduly for a higher rent that covers the cost, especially as the market would also include grandfathered investors and new investors in new stock.

Nonetheless, it is true that tenants don’t have the same degree of power as do most other consumers, because so many of those looking for rental housing need it urgently (you cannot go without a house for long) and because once in a house it is difficult to shop around (moving is financially and emotionally costly). It is possible that this structural imbalance in the individual landlord-tenant relationship could be exploited by landlords who, while ordinarily in competition to meet the market and fill vacant properties, may as a group feel that the scare stories around the supposed impact of negative gearing reform give sufficient cover for a concerted grab at a greater share of the national income.

If that happened, it would be an abuse. If there is genuine concern that a reform of negative gearing may be the occasion for an abuse of this kind, governments could guard against it by legislating for a temporary cap on rent increases while reform is implemented. Let’s see the property lobby get behind that.

![By Joshua Favaloro (Own work) [CC BY-SA 4.0 (http://creativecommons.org/licenses/by-sa/4.0)], via Wikimedia Commons](http://blogs.unsw.edu.au/cityfutures/files/2015/12/Barangaroo_South.jpg)